<script async src="https://pagead2.googlesyndication.com/pagead/js/adsbygoogle.js?client=ca-pub-7467848586067900"

crossorigin="anonymous"></script>

BBC Business Reporter

Global Stocks Have Sunk, A Day After President Donald Trump Announced Sweeping New Tariffs That Are The Forecast to Raise Price and Weigh Growth in The US and Abroad.

The S & P 500, which is the Biggest American firms, plunged 4.8% – ITS Worst Day Since Covid Crashed The Economy in 2020. Earlier in the Day Fell From Asia to Europe.

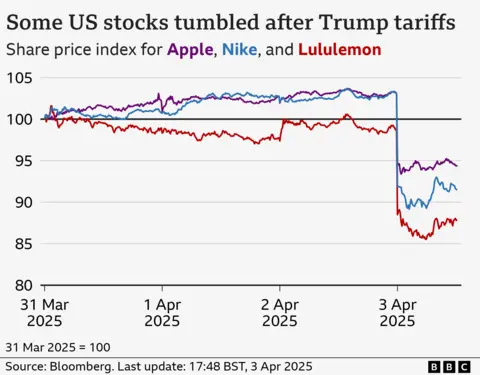

Nike, Apple and Target were Hit Among Big Consumer Names Worst, All Of Them Sinking More Than 9%.

At The White House, the US Economy Would the US Stood “AS HE STOD FOR A MINIMUM 10% TAROFT IMPORTS, WE Argues Will Boost Federal Revenues and Bring American Manufacturing Home.

The Republican President Plans to Hit Products From Dozens Of Other Countries Far Higher Levies, Including Trade Partners Such As China and The European Union.

China, which is facing an aggregate 54% tariff, and the en, which faces duties of 20%, Thursday on Both Vowed Retaliation.

Tariffs Are Taxes On Goods Imported From Other Counters, And Trump’s Plan Announced On Wennesday Would Hike Duties To Highest Levels in More Than 100 Years.

The World Trade Organization Said it “DePlly Conned”, Estimating Trade Volumes Could Shrink As A Result by 1% This Year.

Traders Are Also Concerned About The Global Economic Impact Of Trump’s Tariffs, Which Those Fear Could Stoke Information and Stall Growth.

On Thursday, The S & P 500 Shed Roughly $ 2tn in Value, Continuing A Sell-off That has been logging Since Mid-February Amid Trade War Fears.

The Dow Jones Closed About 4% Lower, While The Nasdaq tumbled roughly 6%.

Earlier, The UK’s FTSE 100 Share Index Dropped 1.5% and other European Markets Also Fell, Echoing Declines in Asia.

On Thursday at The White House, Trump Doubled Down on a High-Stakes Policy Gambit Aimed at the Reversing Decades of US-LED Liberalisation That Shaped The Global Trade Order.

“I Think It’s Going Very Well,” He said. “It was an Operation Like When A Patient Gets Operated, and It’s A Big Thing. I said this What Would be Exactly Be The Way It Is.”

He Added: “The Markets Are Going To Boom. The Stock Is Going To Boom. The Country Is Going To Boom.”

Trump Also Said Was Open To Negotiating Trade Partners On The Tariffs “If Sumebody Said We’re Going To Give You Something So Phenomenal.”

On Thursday, Canada’s Prime Mark Carney Said That Country Would Retaliate With A 25% Levy On Vehicles Imported From The US.

Trump Last Month Imposed Tariffs Of 25% on Canada and Mexico, Though He Did Not Any NEW Duties on the Wednesday Against The North American Trade Partners.

Firms Now Face of Choice of Swallowing The Tariff Cost, Working With Partners to Burden – Or Passing It On To Consumers, and Risking A Drop in Sales.

That could have a major impact as US consumer spending amounts about 10% to 15% of the World Economy, According to Some Estates.

While Stocks Fell on Thursday, What is Seen AS A Safer Asset in Turbulence, Touched A High Of $ 3,167.57 on One Point on Thursday, Before Falling Back.

The Dollar Also Weakened Against Many Current.

In Europe, The Tariffs Could Drag Down by Percentage Point, With A Further Hit the IF Bloc Retaliates, According to Analysts at Principal Asset Management.

In the US, A Recession Is Likely to Materialize Other Changes, Such As Big Tax Cuts, What Trump Start promised, Warned Seema Shah, Chief Global Strategist at The Firm.

She said Trump’s Goals of Boosting Manufacturing Was A Years-Long Process “IF It Happens at All”.

“In The Meantime, The Steep Tariffs On Stikly To Be An Immediate Drag on The Economy, With Limited Short-Term Benefit,” She Said.

On Thursday, Stellantis, What Makes Jeep, Fiat and Other Brands, Said It Was It Was Halting Production at Factory in Toluca, Mexico and Windsor, Canada.

It Said the Move, A Response to Trump’s 25% Tax On Car Imports, Would Lead to Temporary Layoffs of 900 People PLANTS IN THE US Supply Those Those Those Factories.

On The Stock Market, Nike, What Makes Much Of Its Sportswear in Asia, Was Among The Hardest hit on The S & P, Shares Down 14%.

Shares in Apple, which Heavily on China and Taiwan, tumbled 9%.

Other retailers Also Fell, with Target Down Roughly 10%.

Motorbike Maker Harley-Davidson – What was subject to Retaliatory Tariffs by the Trump’s First Term as President and has been a potential target Retaliation Thing Time – Fell 10%.

In Europe, Shareswear Firm Adidas Fell More Than 10%, While Stocks in Rival Puma Tumbled More Than 9% As Key Countries Where Their Goods Hit Were Hit Was Hit With Steep Levies.

Among Luxury Goods, Jewelery Maker Pandora Fell More Than 10%, and Louis Vuitton Moet Hennessy) Dropped More Than 3% After Tariffs Were Imposed on the European Union and Switzerland.

“You’re Seeing Retailers Get Destroyed Now Extended Tariffs To Do Not Expect,” Said Jay Woods, Chief Global Strategy at Freedom Capital Markets, Add We Expected More Turbulence Ahead.