BBC

BBCThe US Has “Dropped The Ball” Chip Manufacturing Over The Years, Allowing China and Other Asian Hubs to Steam Ahead. So Said Gina Raimondo, Who Time Was The US Commerce Secretary, In Interview With Me Back In 2021.

On Four Years, Chips Battleground for the US-China Race, and US President Donald Trump Now Wants to Turbocharge Highly Complex and Delicate Manufacturing Process That has taken Take Later Regions Decades to Perfect.

Hey Says Tariff Policy The US Economy and Bring Jobs Home, But It Is It That The Biggest Companies Have Long Struggled With A Lack Skilled Workers and Poor-Quality Produce in Their American Factories.

So What Will Trump Do Differently? And, Given That Taiwan and Other Parts Have the Secret Sauce Creating High-Precision Chips, Is It Even Possible For The Us To Them Too, And At Scale?

Making microchips: The Secret Sauce

Semiconductors Are Central To Powering Everything From Washing Machines to iPhones, And Military Jets to Electric Vehicles. These Tiny Wafers of Silicon, Known As Chips, But Today, IT is in Asia That The Most Advanced Chips Are Being Produced at Phenomenal Scale.

Making Them Is Expensive and Technologically Complex. An iPhone Example Chips That Were Designed in the US, Manufactured in Taiwan, Japan Or South Korea, Using Raw Materials Like Rare Earths Wow Are Mostly Mined in China. Next to May Be Packaging For Vietnam, Then to China For Asmly And Testing, Before Being Shipped to The US.

Getty Images

Getty ImagesIt is a Deeply Integrated Ecosystem, One That has Evolved Over The Decades.

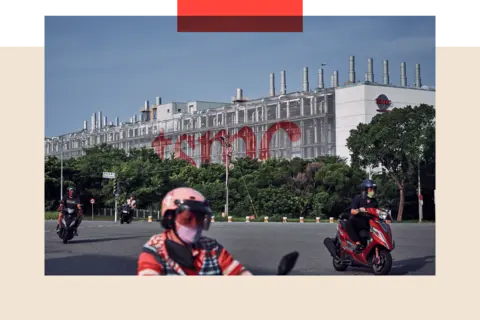

Trump has Praised The Chip Industry But Also Threatened It With It Tariffs. He has trown Industry Leader, Taiwan Semiconductor Manufacturing Company (TSMC), It Would Have A Tax Of 100% IF It Did Not Build Factories in The US.

With Such A Complex Ecosystem, and Fierce Competition, They Need To Be Able To Plan for Higher Costs and Investment calls in the Long term, Well Beyond Trump’s Administration. The Constant Changes to Policies Aren’t Helping. So Far, Some Showns to Willingness to Invest in the US.

The Significant Subsidies That China, Taiwan, Japan and South Korea Have Given Private Companies Developing Chips Are A Big Reason For Their Suitcess.

That Largely Thinking The US Chips and Science Act, Which President Joe Biden – An Effort to Re-Shore Chips And Diversify Grants, Tax Credits, Presidies, Incentivise Domestic Manufacturing.

Getty Images

Getty ImagesSome Companies Largest Chipmaker Tsmc and The World’s Largest Smartphone Maker Samsung Charneficiaries Of The Legislation, Tsmc Receiving $ 6.6 Billion in Arizona, and Samsung Receiving $ 6 Billion for A Facility in Taylor, Texas.

Tsmc Announced A Further $ 100 Investment Intment Intent With The US Trump, Top of $ 65 PLEDged PLEDGED PLANTS FOR THREE. Diversifying Chip Productions Works For Tsmc Too, With China Repeatedly Threatening To Take Control of the Island.

But Both Tsmc and Samsung Challenges With Their Investments, Including Surging Costs, Difficulty Recruiting Skilled Labor, Construction Delay and Resistance From Local Unions.

“This isn’t is a factory where you make Boxes,” Says Marc Einstein, Research Director at Market Intelligence firm counterpoint. “The Factories That Make Chips Are Such High-Tech Sterile Environments, They Take Years and Years to Build.”

And despite the US Investment, Tsmc has said that of the most Most Manufacturing Will Remain in Taiwan, Esexially Its Most Advanced Computer Chips.

Did China Try To Steal Taiwan’s Prowess?

Today, Tsmc’s Plants in Arizona Product High-Quality Chips. But Chris Miller, Author of Chip War: The World’s Most Critical Technology, Argues That “They’re A Generation On the Cutting Edge in Taiwan.”

“The question of Scale depends on How Much Investment is Made in the US versus Taiwan,” Heys. “Today, Taiwan has far more capacity.”

The Reality is, Took Decades For Taiwan to Build Up That Capacity, and Despite Of China Spending Billions to Steal Taiwan’s Prowess in The Industry, It Continues To Thrive.

Getty Images

Getty ImagesThe Tsmc Was The Pioneer Of The “Foundry Model” Where Chip Makers Tok Us Designs And Manufactured Chips for Other Companies.

Riding on a Wave of Silicon Valley Start-Ups Like Apple, Qualcomm and Intel, Tsmc Was Able with US and Japanese Giants with the Best Engineers, Highly Skilled Labor And Knowledge Sharing.

“Could the US Make Chips and Create Jobs?” asks Mr Einstein. “Sure, But Are You Going To Get Down Chips? Probably Not.”

One Reason is Trump’s Immigration Policy, which can potentially Limit The Arrival of the Arrival Skilled Talent from China and India.

“Even Elon Musk hash an immigration problem with Tesla Engineers,” Says Mr Einstein, Referring to Musk’s Support Visa H-1B Visa Program That Skilled Workers To The US.

“That’s a bottleneck and there’s Nothing them do, unless thy change on their Stance. You can’t just magic phds out of nowhere.”

The Global Knock-On Effect

Even So, Trump Has Doumbed Down Tariffs, Ordering a National Security Trade Investigation Into The Semiconductor Sector.

“It’s A Machine – A Big Wrench,” Says Mr Einstein. “Japan for example was Basing ITS Economic Revitalisation on Semiconductors and Tariffs were not in the Business Plan.”

The longer-term impact on The Industry, According to Mr Miller, Is Likely to Be a Renewed Focus on the Domestic Manufacturing In Many’s Key Economies: China, Europe, The US.

Some companies coupets Could Look for New Markets. Chinese Technology Giant Huawei, Expanded Into Europe and Emerging Markets Including Thailand, The UAE, Saudi Arabia, Africa in the Face of Export Controls and Tariffs, Although The Margins in Developing Nations Are.

“China Ultimately Will to Win – It Has to Invest and Invest in R & D. Look at What It Did Didseek,” Says Mr Einstein, Referring to The China-Built AI Chatbot.

“IF to Build Better Chips, Everyone Is Going To Them. Cost-Effectiveness Is Something You Can Do Now, and Looking Forward, It’s The Ultra-High-Tech Fabrication.”

In the Meantime, New Manufacturing Hubs May Emerge. India has been promise, According to Experts Who Is More Chance Of It Bezoming Integrated Into The Chip Supply Chain Than The Us – It’s Geographical Closer, Labor Is Cheap and Education Is Good.

India has been signalled That it is an open to chip manufacturing, but it faces a number of challenges, including Land for factories, and water – Chip Production Needs The Highest Quality Water And A Lot.

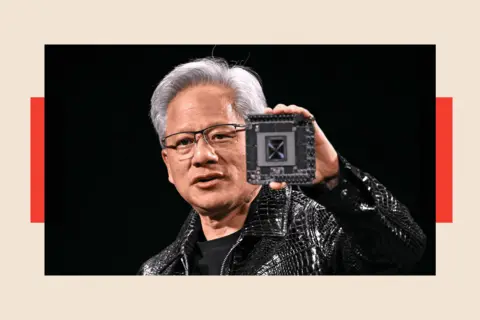

Bargaining chips

Chip Companies Are Not Completely at The Mercy of Tariffs. The Sheer Reliance and Demand Chips From Major US Companies Like Microsoft, Apple and Cisco Could Apply Pressure on Trump to Reverse Any Levies on The Chip Sector.

Some Insiders Believe Intense Lobbying by Apple Cook Secured The Exemptions To Smartphone, Laptop And Electronic Tariffs, Lifted A Ban On The Chips Can Sell to China As A Result Of Lobbying.

Asked Specifically About Monday Products, Trump Said, “I’m A Very Flexible Person,” Adding That “There Be Be Maybe Things Up, I Help Tim Cook Recently.”

Getty Images

Getty ImagesMr Einstein Thinks Down to Trump Ultimately Trying To Make a Deal – He And His Administration Know They Can’t Just Build a Bigger Building When It Is Comes To Chips.

“I Think What The Trump Administration is What It has been doing?

“I Think Thy’re Tryangle Something Something Similar to Here – Tsmc Isn’t Going Anywhere, Let’s Just Force Them To Do a Deal With Intel and Take a Slice Of The Pie.”

But The BluePrint Of The Asia Semiconduct Ecosystem Lesson: No One Country Can Operate Another Chip Industry, and IF You Want to Make Semiconductors, Efficiently And At Scale – It Will Take Time.

Trump Is Trump to Create a Chip Industry Through Protectionism and Isolation, When What Allowed The Chip Industry To Emerge Throughout Asia is the Opposite: Collaboration in Economy.

BBC INDEPTH Is The New Home On The WebSite And App For The Best Analysis And Expertise From Our Top Journalists. Under a distinctive New Brand, We’re Bring You Fresh Perspectives That Challenge Assumptions, And Deep Reporting On The Biggest Issues to Help You Make Sense Of A Complex World. And We’ll Be Showcasing Thought-Provoking Content From Across BBC Sounds And Iplayer Too. We’re Starting Small But Thinking Big, and We Want To Know What You Think – You Can Send Us Your Feedback Clicking On The Button Below.