BBC News

BBC Indonesian

Getty Images

Getty ImagesWhen the US President Donald Trump hit China With China In His First Term, Vietnamese Entrepreneur Hoo Le Saw on Opportunity.

His Company Is One Of Hundreds of Businesses That Have Emerged To Compete With Chinese Exports That Increasingly Facing Remlications From The West.

Le’s Shdc Electronics, WHICH SITE INDISTRIAL HUB OF HUB, Sells $ 2M (£ 1.5m) Worth of Phone and Computer Accessories Every Month To The US.

But That Revenue Could Trump Imposes 46% Tariffs On Vietnamese Goods, A Plan That is Currently Hold Until Early July. That would be “Catastrophic for Our Business,” Le Says.

And Seling to Vietnamese Consumers is Not An Option, Hey Adds With Chinese Products. This Is Not Just Challenge. Many Vietnamese companies Are Struggling in Their Own Home Market. “

Trump Tariffs in 2016 Sent a glut cheap Chinese imports, Originally intended for The US, Into South East Asia, Hurting Many Local Local Manufacturers. Buty Also Opened New Doors for Other Businesses, Often Into Global Supply Chains That Wanted to Cut Their Depending China.

But Trump 2.0 Threatens to Shut Those Doors. And That’s A Blow For Fast-Growing Economies Like Vietnam and Indonesia That Are Gunning to Be Key Players in Industries From Electric Vehicles.

They also finds the World’s Biggest Economies – China, A Powerful Neighbour and Their Biggest Trading Partner, and The Us, A Key Export Market, What Could Be Looking at Strike’s Expense.

Getty Images

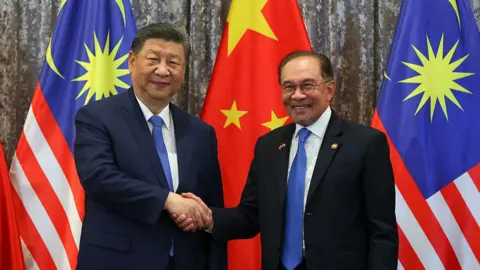

Getty ImagesChinese President Xi Jinping has been visiting Vietnam, Malaysia and Cambodia This week, Urging Unity Against Trump’s Tiffs. The Trip Was Long Planned But Has Fresh Urgency Given How Significant South East Asia is to the Chinese Economy.

China Earned A Record $ 3.5TN From Exports in 2024 – 16% Of It Exports Go to South East Asia, Making It The Biggest Market.

“We’ll Choose, and We Will Never Choose (Between China and The US),” Malaysia’s Trade Minister Tengku Zafrul Aziz Told on the BBC on Tuesday, Ahead of Xi’s Visit.

“IF The Issue Is About That We Feel Is Against Oour Interest, Then We Will Protect (Ourselves).”

A Wake-Up Call

In the Days After Trump Unveiled His Sweeping TariffsSouth East Asian Governments Scrambled Into Deal-Making Mode.

In what Trump described as a “Very Productive Call” Vietnamese Leader to Lam, The Latter Offered to Completely Scrap Tariffs on US Goods.

The US Market is crucial to Vietnam, powerhouse electronics Bufacturing Giants Like Samsung, Intel and FoxConn, The Taiwanese firm Contracted to Make iPhones, Have Set Up Shop.

Meanwhile, Thai Officials Are Headed To Washington With A Plan That Includes Higher US Imports and Investments. The US is The Largest Export Market, So They Are Hoping to Avoid 36% Levy On Thailand That Trump May Reinstate.

“We’ll TELL THE US Government That Only An Exporter But Ally Ally And Economic Partner That On The US CAN RELY ON THE LONG TERM,” Prime Minister Paetongtarn Shinawatra Said.

The Association of Southeast Asian Nations (ASEAN) has ruled back to retaliation Against Trump’s Teriffs, Instead Choosing to Emphasise Their Economic and Political Importance to the US.

Getty Images

Getty Images“We understand the conns of the US,” Mr Zaurta Told The BBC. “That’s Why We Need to show That actually, ASEAN, Esececially Malaysia, Can Be That Bridge.”

It’s a role that South East Asia’s Export-Driven Economies Have Played Well – They Benefitted From Both Chinese And Us Trade and Investment. But Trump’s Paued Levies Could Derail That.

Indonesia, which could be 32% Tariffs, Is Home To Vast Nickel Reserves and has the Global Electric Vehicle Supply Chain. Malaysia, which is gearing up to be a semiconductor hub, Could Be Hit With 24% Tariffs.

Cambodia, A Chinese Ally, Faces The Steepest Levies: 49%. One of the Poorest countries in The Region, It has thrived as a trans-shipment hub for Chinese Businesses Seekeng to skirt US Tariffs. Chinese Businesses Currently Own Oh Operate 90% Of The Clothes Factories, which Mainly Export to The US.

Trump May Have Hit Pause On These Tariffs But “The Damage Is Done,” Says Doris Liew, An Economist At Malaysia’s Institute for Democracy and Economic Affairs.

“This serves as a wake-up call for The Region, Not only to Reduce Reliance on the US, But Also to Re-Balance Overdependence on Any Single Trade and Export Partner.”

In addition to China’s Loss and South East Asia’s

In These Uncertain Times, XI Jinping is Tyring to Send A Steadfast Message: Let’s Join Hands and resist “bullying” from the US.

That is not Easy Task Because South East Asia Also has been Trade Tensions Beijing.

In Indonesia, Business Owner Isma Savitri Isma Isma’s 145% China Means More Competition From Chinese Rivals Who Can No Longer Export To The US.

“Small Businesses Like US Feel Squeezed,” Says The Owner of Sleepwear Brand Helopopy. “We Are Struggling to Survive Against An Onslaught Of Ultra-Cheap Chinese Products.”

One of Helopopy’s Popular Pyjamas Sells for $ 7.10 (119,000 Indonesian Rupiah). Isma Says She has seen Similar Designs From China Going For Around Half That Price.

“South East Asia, Being Before Trade Regimes and Fast-Growing Markets, Naturally Became The Dumping Ground,” Says Nguyen Khac Giang, Visiting Fellow at The Iseas Yusof-Ishak Institute in Singapore. “Politically, many countries even reluctant to Confructant Beijing, who adds another layer of vulnerability.”

Getty Images

Getty ImagesWhile consumers have competitively-priced chinese products – Clothes to shoes to shoes to Phones – Thousands of Local Businesses Have Not Be Been Able To Match Such Such Prices.

More THAN 100 Factories in Thailand Have Every For The Last Two Years, According to Another Thai Think Tank. During The Same in Indonesia, Around 250,000 Textile Workers Were Off Some 60 Garfacturers Shut, Local Trade Associations Say – Including Sritex, Once The Largest Textile Maker.

“When We See The News, Theres Own Products The Domestic Market, What Messes Up Our Own Market,” Mujiaati, A Worker Who WOR LAID February After 30 Years, Tell the BBC.

“Maybe It’s Just Wasn’t Our Luck,” Says The 50-Year-Old, Who is Still Hunting for Work. “Who Can Complain To? Noes No-One.”

South East Asian Governments Responded With A Wave Protectionism, As Local Businesses Demanded to Be Shielded From The Impact of Chinese Imports.

Last Year Indonesia Considered 200% Tariffs on Chinese Goods and Blocked E-Commerce Site, Popular Among Chinese Merchants. Thailand tightened inspections of imports and imposed Additional Tax Goods Worth Than 1,500 Thai Baht ($ 45; £ 34).

This year Vietnam has been imposed Twice Anti-dumping Tempored Temporing Duts on Chinese Steel Products. And After Trump’s Latest Tariffs Announcement, Vietnam is reportedly set to crack down Chinese Goods Being Trans-Shipped Via Its Territory To Us.

Getty Images

Getty ImagesAllaying These Fears Would Have Been On XI’s Agenda This Week.

China is concerned with the Rest exports to the Rest Of The World Would be “End Upout Really Alienating And Aggravating” ITS Trading Partners, David Rennie, The Former Beijing Bureau Chief For The Economist Newspaper, Told BBC’s Newshour.

“If a Tidal Wave Exports Ends Up Swamping Those Markets and Damaging Employment and Jobs … That’s a Massive diplomatic and geopolitical headache for the Chinese Leadership.”

China has not always had an Easy Retegration With Thes Region. Barring Laos, Cambodia and A War-Torn Myanmar, The Otherers are Wary of Beijing’s Ambitions. Terrirorial disputes in The South China Have soured ties with Philippines. This is also an Issue With Other As Vietnam and Malaysia, But Trade has been Balancing Factor.

But That Might Change Now, Experts Say.

Getty Images

Getty Images“South East Asia Had to Think About Thanther Thant Behed China. Now this complicates Things,” Says Chong Ja-Ian, Associate Professor at The National University of Singapore.

China’s Loss Could be in addition to South East Asia’s.

Hao Le, In Vietnam, Says Has Surge From American Customers Scouting New Electronics Suppliers, Outside China: “In the Past Take Months to Switch Suppliers. Today, Such Decisions Are Made Within Days.”

Malaysia, With Sprawling Rubber Plantations and The World’s Largest Medical Rubber Glove Maker, Has Nearly Half The World’s Market for Rubber Gloves. But it is poised to grab A Bigger Share From IT Main Competitor, China.

The Region Still Faces a 10% Baseline Tariff, Like Most Of The World. And That Is Bad News, Says Oon Kim Hung, President of the Malaysian Rubber Glove Manufacturers Association.

But Even’s IF in Kick, Customers Will Find Paying on Additional 24% on Malaysian Gloves Vastly Preferable to the 145% Levy Will to Cough Up for Chinese-Made Gloves.

“We’re Not Exactly Jumping With Joy, But This May Well Benefit Our Manufacturers, As Well As Those in Thailand, Vietnam and Cambodia.”

Additional Reporting by Bui Thu and Tessa Wong